Hidden gems lurk. Yes, in the vast world of finance, where your hard-earned dollars can either languish or multiply, finding the best high-yield savings accounts feels like uncovering buried treasure—except it’s not about pirates, it’s about outsmarting inflation. Here’s the uncomfortable truth: sticking with a traditional savings account might be costing you hundreds in lost interest annually. But imagine turning that around, watching your balance grow faster than you thought possible. This guide dives into where to snag those top high-yield savings accounts, drawing from real experiences and smart strategies, so you can boost your financial security without the fluff.

My Unexpected Savings Epiphany

Picture this: a few years back, I was just like many—complacent with my standard bank account, earning a measly 0.01% APY. Then, during the 2020 economic rollercoaster, I watched my emergency fund shrink in real terms due to rising costs. It hit me hard, like a plot twist in a thriller movie. «Wait, why am I letting inflation eat my savings?» I thought, and that’s when the research began. Through trial and error, I discovered high-yield savings accounts offering up to 4-5% APY from online banks. The lesson? Don’t wait for a crisis; proactive moves pay off. In my case, switching netted me an extra $500 in a year on a modest $10,000 balance. Opinions vary, but I firmly believe that in today’s volatile market, prioritizing high-yield savings accounts is non-negotiable for anyone serious about wealth building.

To add a cultural nod, here in the U.S., we’ve got this «American Dream» mentality—work hard, save smart. Yet, many overlook how institutions like Ally or Marcus by Goldman Sachs redefine that by offering competitive rates without the brick-and-mortar fees. It’s like comparing a sluggish old jalopy to a sleek electric car; one barely moves, the other zooms ahead. And just to keep it real, I’m not perfect—I once overlooked the fine print on minimum balances, which cost me a potential bonus. But that’s finance for you: full of quirks.

From Great Depression Rates to Today’s High-Yield Boom

Ever wonder how interest rates have shaped our financial habits? Back in the 1930s, during the Great Depression, savings accounts offered next to nothing, forcing people to get creative with investments. Fast-forward to now, and we’re in a different era, with the Federal Reserve’s policies making high-yield savings accounts more accessible than ever. It’s a stark comparison: then, rates hovered around 0.5%, today, you can find options pushing 5% APY from digital-first banks. This evolution isn’t just numbers; it’s about empowerment, letting everyday folks like us combat economic uncertainty.

But let’s address a common myth: that high-yield means high risk. Not true—most are FDIC-insured, just like traditional ones. I remember chatting with a skeptical friend over coffee, him saying, «Why bother? Banks are all the same.» I countered with facts: platforms like SoFi or Discover not only offer better rates but also user-friendly apps. It’s like debating vinyl vs. streaming; both work, but one fits modern life better. And here’s an unexpected analogy: managing your savings is like tending a garden—neglect it, and weeds take over; nurture it with the right tools, and you harvest abundance. In essence, exploring historical contexts reveals that best high-yield savings accounts aren’t a fad; they’re a smart adaptation.

| Bank | APY Range | Minimum Deposit | Advantages |

|---|---|---|---|

| Ally Bank | 4.25% – 4.50% | $0 | No fees, easy transfers |

| Marcus by Goldman Sachs | 4.40% – 4.60% | $0 | High rates, no balance requirements |

| SoFi | 4.50% – 4.60% | $0 | Integrated financial tools, bonuses for new users |

Demystifying the Search for Top High-Interest Options

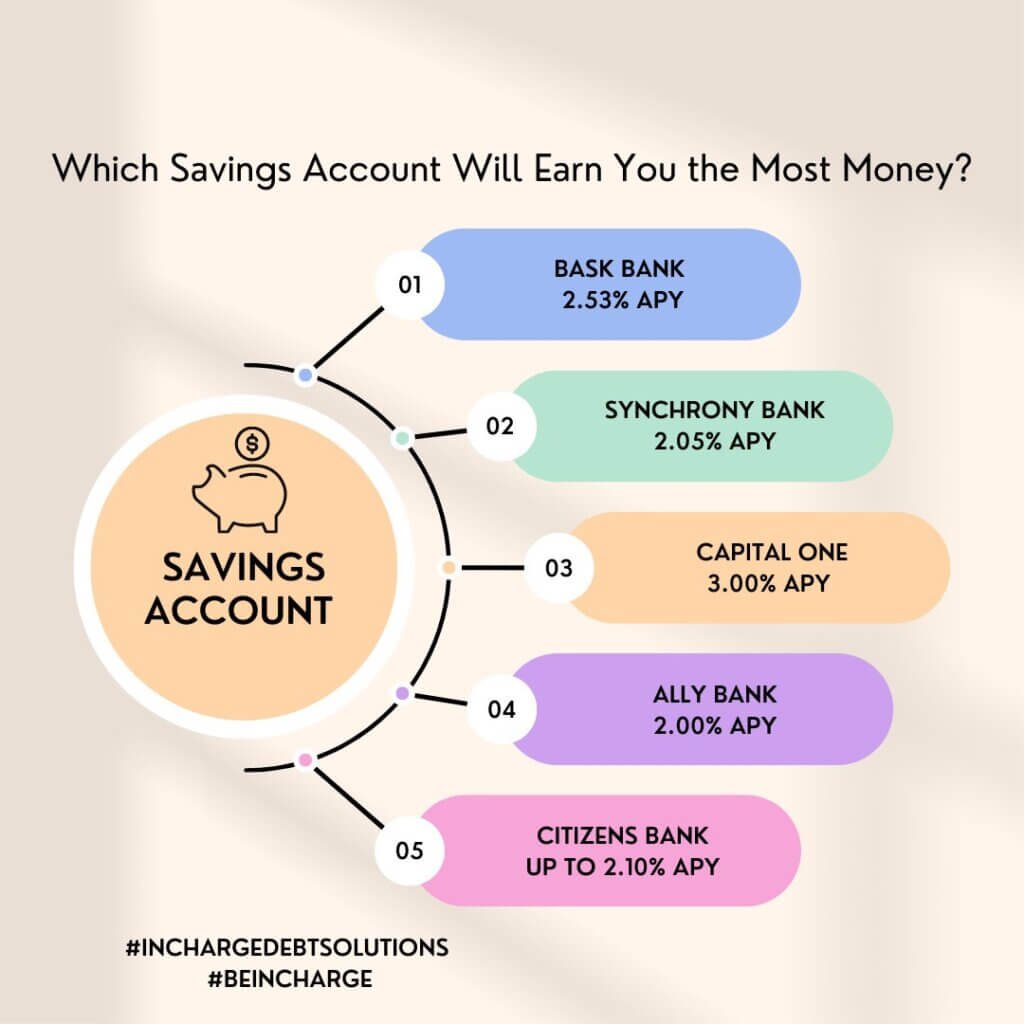

So, you’re ready to dive in, but the options feel overwhelming—where exactly do you find the best high-yield savings accounts? Start by questioning: Why settle for average when exceptional is within reach? For instance, online banks often lead the pack because they cut overhead costs, passing savings to you in higher APY. In my journey, I compared platforms like Capital One 360 and found their rates beat traditional giants hands down. And that’s not all; tools like Bankrate or NerdWallet can be your allies, offering unbiased comparisons without the sales pitch.

Now, for a quick experiment: Grab your current statement and calculate potential earnings. If you have $5,000 at 0.01% APY, you’re earning pennies. Switch to 4.5%, and that’s about $225 a year—money that could buy you something meaningful. Irony hits when you realize big banks push loyalty, but their rates lag. The solution? Focus on factors like liquidity and customer service. For us stateside folks, remember the idiom «putting your money to work»—that’s exactly what these accounts do. Oh, and don’t forget, «A penny saved is a penny earned,» but with high-yield, it’s more like dollars multiplied.

Wrapping this up with a cultural pop reference: Think of it like the steady compound interest in «It’s a Wonderful Life»—small, consistent choices lead to big outcomes. In finance, that means selecting accounts from reputable sources, ensuring they’re not just high-yield but also secure.

A Final Twist on Your Financial Future

Here’s the twist: While we’ve covered the where and how, the real game-changer is action now, before rates fluctuate again. So, don’t just read—check rates at Ally or Marcus today and open an account. What’s holding you back from transforming your savings strategy? Reflect on this: In a world of economic ups and downs, are you content watching your money idle, or ready to make it thrive? Share your thoughts in the comments; I’d love to hear your high-yield success stories.