Debt creeps in silently. It’s the uninvited guest at life’s party, turning celebrations into crises for millions. Did you know that over 50% of Americans carry credit card debt, with averages tipping $6,000? Yet, amidst this financial fog, seeking credit counseling services often feels like wandering a maze without a map—overwhelming, confusing, and riddled with misinformation. But here’s the benefit: the right guidance can transform your financial health, offering tailored strategies to slash debt, rebuild credit, and reclaim peace of mind. In this article, we’ll navigate where to find these essential services, drawing from real experiences and expert insights to empower your journey toward stability.

My Tangled Web: A Personal Tale of Debt and Discovery

Picture this: back in 2015, I was juggling bills like a circus act gone wrong, my credit score dipping lower than a Hollywood plot twist. Working as a freelance writer in New York, expenses piled up—rent in a city that never sleeps, medical bills that hit like a punch, and credit cards maxed out faster than you can say «interest rates.» It was humiliating, really; I’d always prided myself on being the responsible one, but there I was, one late payment from disaster. That’s when I stumbled upon credit counseling services through a friend’s recommendation—nothing fancy, just a local nonprofit agency affiliated with the National Foundation for Credit Counseling (NFCC).

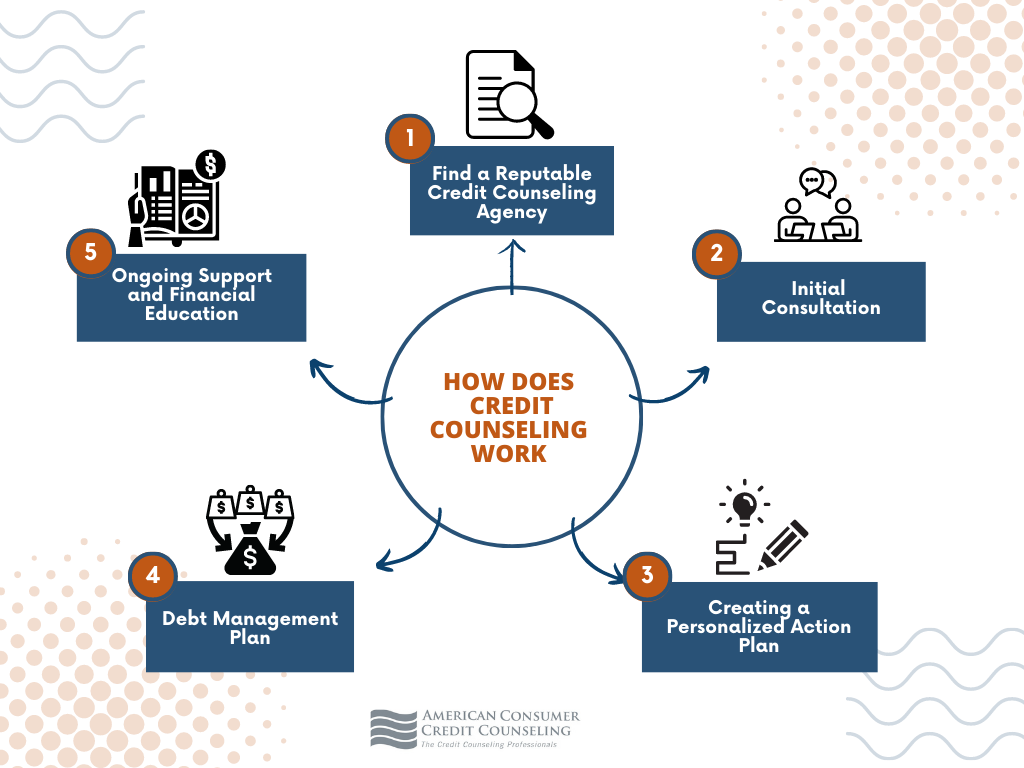

This isn’t just a story; it’s a lesson etched in red ink. Credit counseling isn’t about judgment; it’s about personalized debt management plans that analyze your budget, negotiate with creditors, and guide you step-by-step. I remember the counselor, a no-nonsense veteran named Maria, who broke down my finances with metaphors I’d never forget—like comparing compound interest to a snowball rolling downhill, gathering size and speed. Her advice? Start with free consultations from accredited agencies, which are often backed by the U.S. Department of Justice. Opinions vary, but mine is firm: if you’re drowning in debt, seeking help early can prevent a full-blown crisis. And just like that New York minute, my life shifted—from chaos to control.

From Medieval Ledgers to Digital Dashboards: The Evolution of Financial Guidance

Ever thought about how our ancestors handled debt? In medieval Europe, moneylenders kept track of loans on parchment scrolls, often leading to public shaming for defaulters—talk about a cultural comparison that hits home. Fast forward to today, and credit counseling services have morphed into sophisticated tools, blending technology with human empathy. In the U.S., this shift mirrors our cultural obsession with innovation, from the Great Depression’s debt relief programs to modern apps like those offered by the Financial Counseling Association of America (FCAA).

Here’s an unexpected analogy: if ancient ledgers were like handwritten diaries, today’s services are akin to a smart GPS for your wallet, rerouting you away from financial pitfalls. A common myth is that credit counseling damages your credit score, but the truth is more nuanced—agencies often work to improve it by consolidating debts and establishing payment plans. For instance, comparing historical practices to now, we see a table of evolution that highlights key advantages:

| Era | Approach | Advantages | Disadvantages |

|---|---|---|---|

| Medieval Times | Personal lenders and community oversight | Direct accountability; built-in social support | Limited access; potential for exploitation |

| Modern Day | Certified agencies and online platforms | Confidential advice; tools for budgeting and education | Requires proactive seeking; fees can vary |

This comparison underscores why, in our fast-paced world, places like the Consumer Financial Protection Bureau (CFPB) recommend seeking services from HUD-approved housing counselors or NFCC members for reliable, culturally relevant support. It’s not just about numbers; it’s about adapting to life’s rhythms, whether you’re in a bustling city or a quiet suburb.

Chatting with Doubt: Why You Might Hesitate and How to Overcome It

Imagine you’re sitting across from me at a coffee shop, skepticism etched on your face. «Why bother with credit counseling?» you’d say, arms crossed. «Isn’t it just another bill to pay?» Fair point, but let’s unpack that with a mini experiment: grab a pen and jot down your monthly expenses for a week. What you’ll find, probably, is that unmanaged debt sneaks in like that plot twist in «The Big Short»—subtle at first, then overwhelming. In finance circles, this hesitation stems from outdated stigmas, like thinking counselors are debt collectors in disguise, when in reality, they’re educators armed with resources from the Association for Financial Counseling and Planning Education (AFCPE).

And that’s when it hits you—the real solution lies in verified sources. Start by checking online directories from the NFCC or FCAA, which list accredited counselors who offer free initial assessments. For a serious tone, I’ll add my subjective take: ignoring this step is like driving without a seatbelt in uncertain economic times. To make it actionable, consider this exercise: reach out to three local agencies today, compare their credit counseling fees and services, and note how they address your specific needs, such as student loans or credit card debt. It’s not about perfection; it’s about progress, with a nod to pop culture—like how Walter White in «Breaking Bad» had to face his messes head-on to rebuild.

In wrapping this up, here’s a twist: what if seeking credit counseling isn’t just about fixing finances, but about unlocking a freer version of yourself? It’s the quiet empowerment that comes from knowledge, turning debt from a chain into a lesson learned. So, take that step now—visit the NFCC website and schedule a free session to start your path. And you, reader: what’s one financial habit you’ve changed that made a real difference? Share in the comments; let’s build a community of informed voices.