Money whispers secrets. In the world of finance, where traditional banks often feel like unyielding fortresses, peer-to-peer lending emerges as a disruptive force that’s reshaping how we borrow and invest. But here’s the uncomfortable truth: not everyone realizes that this model can cut out the middleman, offering everyday people better interest rates and more inclusive opportunities. If you’re tired of rigid loan processes or low-yield savings, exploring peer-to-peer (P2P) lending could unlock a path to smarter financial growth. Stick around, and I’ll share why this might just be your next smart move in the investment landscape.

My Unexpected Dive into P2P Lending

Picture this: a few years back, I was drowning in student loans, and traditional banks treated me like just another number in their spreadsheet. That’s when a friend, who’s as savvy with money as Sherlock Holmes is with clues, introduced me to P2P lending platforms. It wasn’t some grand epiphany; it was more like stumbling upon a hidden alley in the financial district. I remember hesitating, thinking, «Is this really safer than the big banks?» But after diving in, I saw firsthand how it democratizes access—borrowers get funds without the bureaucratic hassle, and investors like me earn returns that beat inflation.

This personal anecdote isn’t just feel-good nostalgia; it’s a grounded opinion based on real numbers. According to reports from platforms like LendingClub, P2P lending has helped millions secure loans at rates up to 36% lower than traditional options for qualified borrowers. Yet, it’s not all roses—I’ve faced the occasional delay in repayments, which taught me the value of diversification. In a country like the US, where the American dream often hinges on credit scores, P2P offers a piece of the pie to those sidelined by conventional finance. And just like in that iconic scene from «The Wolf of Wall Street,» where Jordan Belfort exposes the system’s flaws, P2P flips the script by putting power back in your hands.

From Ancient Barter to Digital Loans: A Historical Evolution

Let’s rewind the clock—way back to when communities traded goods in open markets, long before Wall Street’s skyscrapers dominated the skyline. Peer-to-peer lending isn’t a new fad; it’s an evolution of that age-old barter system, adapted for our digital era. In historical contexts, like the microfinance movements in developing countries, people have always lent directly to neighbors to foster community growth. Fast-forward to today, and P2P platforms are the modern equivalent, bridging gaps that traditional banking ignores.

Compare this to the rigidity of banks: while institutions hoard profits and impose strict criteria, P2P uses algorithms to match lenders and borrowers, often with lower fees and faster approvals. Think of it as swapping a horse-drawn carriage for an electric vehicle—both get you there, but one is more efficient and accessible. In the UK, for instance, where «making a bob or two» is a common phrase for earning extra, platforms like Zopa have revolutionized personal finance by offering rates that outpace inflation. The irony? This «new» system echoes ancient practices, proving that financial innovation isn’t always about reinvention but refinement. And that’s when it hit me—P2P isn’t just lending; it’s a cultural shift towards equity.

A Closer Look at the Mechanics

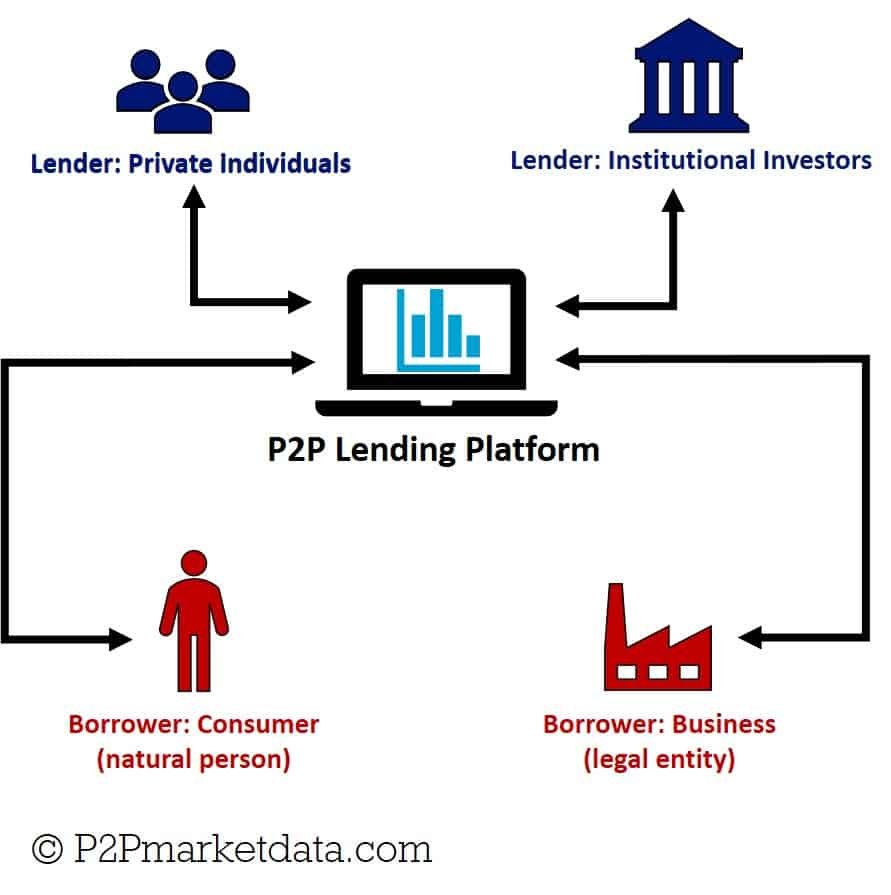

Digging deeper, P2P lending platforms use technology to assess risk, much like how Netflix recommends shows based on your viewing history. This personalization means investors can pick loans that align with their risk tolerance, from safe, steady returns to higher-stakes opportunities. It’s a far cry from the one-size-fits-all approach of banks, which often leave you feeling like you’re bargaining in a basement sale.

The Risks That Lurk in Shadows – And How Vigilance Prevails

Now, let’s address the elephant in the room: P2P lending isn’t without pitfalls. In a serious financial world, ignoring risks is like walking a tightrope without a net. For starters, default rates can spike during economic downturns, potentially eroding your returns faster than a stock market crash. I once invested in a loan that went south due to unforeseen circumstances, leaving me to ponder the fragility of peer-based trust.

But here’s the silver lining—and it’s no myth: with proper due diligence, these risks are manageable. Platforms often provide tools for credit scoring and diversification, turning potential pitfalls into calculated moves. Irony aside, while traditional banking boasts «safety,» P2P offers transparency that lets you see exactly where your money goes. A simple comparison might help clarify:

| Aspect | Traditional Banking | P2P Lending |

|---|---|---|

| Interest Rates | Often lower for savers, higher for borrowers | Competitive rates for both sides |

| Accessibility | Strict eligibility | More inclusive for underserved groups |

| Risks | Institutional failures (e.g., 2008 crisis) | Individual defaults, but diversified options |

By educating yourself—say, by reviewing platform ratings or starting small—you can mitigate these issues. In the US, where «don’t put all your eggs in one basket» is sage advice, spreading investments across multiple loans is key. This approach not only protects your portfolio but also enhances financial inclusion, a benefit that’s profoundly impactful for underrepresented communities.

Wrapping Up with a Fresh Perspective

In conclusion, peer-to-peer lending flips the traditional finance narrative on its head: what if the path to wealth wasn’t guarded by elite institutions but shared among peers? It’s not just about returns; it’s about reclaiming control in an unequal system. So, take action now—sign up for a reputable P2P platform and explore your first investment today. And reflect on this: how might your financial choices today shape tomorrow’s opportunities for others? Share your thoughts in the comments; let’s keep the conversation going.