Hidden dangers lurk in the seemingly steady world of stocks, where one bad quarter can turn your nest egg into a cracked shell. Think about it: in 2008, the global stock market lost over $50 trillion in value almost overnight, leaving even the savviest investors reeling. Yet, many folks still pour all their hard-earned cash into equities, ignoring the volatility that could upend their financial dreams. This article dives into why diversifying beyond stocks isn’t just smart—it’s essential for safeguarding your wealth and sleeping better at night. By exploring alternative investments, you’ll reduce risks and unlock steady growth, turning your portfolio into a resilient fortress rather than a house of cards.

My Unexpected Market Meltdown: A Personal Tale

I remember it like it was yesterday, back in 2015 when my stock-heavy portfolio took a nosedive during that summer slump. I’d put everything into tech giants, figuring they were untouchable—after all, who doesn’t love a good Apple or Amazon stock? But then, global uncertainties hit, and bam, I watched my gains evaporate. It was a gut punch, realizing I’d over-relied on stock market diversification pitfalls. That experience taught me a hard lesson: stocks might promise high returns, but they’re like that unreliable friend who shows up late and leaves you hanging.

Fast forward, and I’ve since woven in bonds and real estate, which provided a buffer when stocks wobbled again. This isn’t just my story; it’s a common thread in finance circles. Opinions vary, but mine is straightforward—diversifying beyond equities creates balance. As someone who’s been through the wringer, I say skip the all-in approach; it’s like betting your life’s savings on a single horse race. And just there, in the midst of that chaos, I discovered how portfolio diversification strategies can turn potential losses into mere speed bumps.

Echoes of the Great Depression: Historical Wake-Up Calls

Picture this: the 1929 stock market crash, where millions lost fortunes overnight, echoing through history as a stark reminder of what happens when diversification gets ignored. Back then, folks were as hooked on stocks as we are on our smartphones today—it’s almost like a scene from «The Wolf of Wall Street,» where the frenzy blinds everyone to the risks. But let’s get real; comparing that era to now shows how little we’ve learned. In modern finance, over-concentration in stocks can lead to the same pitfalls, amplified by today’s interconnected global economy.

Culturally, in the U.S., we often hear the old saying «don’t put all your eggs in one basket,» which rings truer than ever in investment talks. Historically, diversified portfolios—mixing stocks with bonds or commodities—have weathered storms better, as seen in the post-2008 recovery. This isn’t about bashing stocks; they’re vital for growth. Yet, as an investor who’s dug into the numbers, the truth is uncomfortable: relying solely on them exposes you to market swings that could derail your goals. By branching out, you’re not just protecting assets; you’re building a legacy, much like how diversified economies bounce back faster from recessions.

A Closer Look at Asset Classes

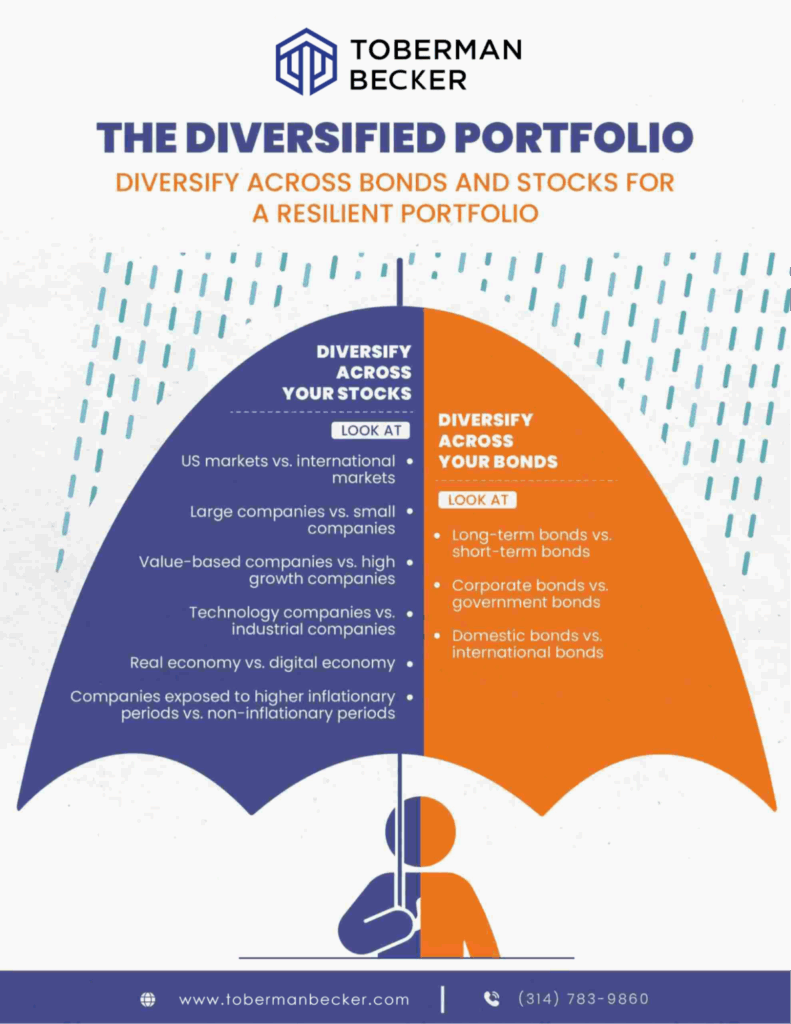

To make this concrete, consider how different investments stack up. For instance, while stocks offer high potential returns, bonds provide stability with steady interest—think of it as the reliable sidekick to stocks’ flashy lead. Here’s a quick comparison to illustrate:

| Asset Type | Key Benefits | Potential Drawbacks |

|---|---|---|

| Stocks | High growth potential, liquidity | Volatility, market dependency |

| Bonds | Stable income, lower risk | Lower returns, inflation sensitivity |

| Real Estate | Tangible asset, appreciation over time | Illiquidity, maintenance costs |

This table isn’t exhaustive, but it highlights why beyond stocks investment options add layers to your strategy, reducing overall portfolio risk through that age-old wisdom of not putting all eggs in one spot.

The Stock Mirage: Facing Realities with a Serious Eye

Here’s the irony: many chase stocks for security, only to find they’re chasing shadows when markets turn. Take the recent crypto boom and bust—wait, no, stick to finance here—but you get the point; it’s like assuming a single path leads to treasure, when detours often save the day. In finance, this problem manifests as undiversified investment risks, where economic shifts can wipe out gains built over years. My take? It’s not about ditching stocks; it’s about smart allocation.

To tackle this, start by assessing your current holdings—do a quick audit, perhaps. Step 1: List your assets and their exposure. Step 2: Identify gaps, like lacking in fixed-income securities. Step 3: Explore alternatives, such as mutual funds or ETFs that span multiple sectors. And that’s when it hits—diversification isn’t complicated; it’s about creating a safety net. For instance, adding international stocks or precious metals can counter domestic downturns, making your portfolio as robust as a well-anchored ship in stormy seas. This approach, backed by financial experts, turns potential pitfalls into opportunities for steady growth.

In wrapping up, while stocks remain a cornerstone of wealth building, limiting yourself is like ignoring half the toolbox. That twist? Even Wall Street pros diversify heavily, proving it’s not just for novices. So, take action now: review your portfolio and add at least one non-stock element today—your future self will thank you. What overlooked risks in your investments are keeping you up at night, and how will you address them through diversification? Let’s discuss in the comments; your story might just help someone else.