Hidden financial traps – that’s what credit utilization ratios often are, lurking in the shadows of your wallet without a second glance. Did you know that nearly one-third of your credit score hinges on this single metric? It’s a stark contradiction: you might be paying bills on time, yet ignoring how much credit you’re using could tank your financial standing faster than a bad stock pick. In a world where credit utilization ratios can make or break loan approvals, monitoring them isn’t just smart—it’s your ticket to better interest rates, financial freedom, and peace of mind. Stick around, and I’ll walk you through why keeping an eye on this often-overlooked aspect is crucial for your everyday money game.

My Wake-Up Call with Credit Ratios

Let me take you back to 2015, when I was juggling a new job and a pile of credit cards like they were hot potatoes. Picture this: I’d maxed out a couple without realizing it, thinking as long as I paid the minimum, I was golden. Wrong. My credit score dipped below 650, and suddenly, that dream car loan evaporated. It was a real eye-opener, especially since I’d always prided myself on being debt-savvy. In my opinion, based on years of watching friends stumble the same way, ignoring credit utilization is like driving with the handbrake on—you’re moving, but not efficiently, and it wears everything down faster.

This personal blunder taught me a hard lesson: credit utilization ratios, which measure how much of your available credit you’re actually using, directly impact your financial health. For context, if you have a $10,000 limit and owe $3,000, you’re at 30%. Lenders see high ratios as risky, signaling potential over-reliance on credit. And just there, when you least expect it, your score takes a hit. Using an unexpected metaphor, it’s like carrying a backpack that’s too heavy for a hike—it slows you down and could trip you up entirely. If you’re in the US, where consumer debt hits record highs, this hits close to home; think about how «biting the bullet» on monitoring could save you from that debt spiral.

Lessons from Economic History

Ever wonder how ancient trade routes or modern economic booms tie into something as mundane as tracking credit utilization? Let’s draw an unexpected comparison: during the Roaring Twenties, unchecked borrowing fueled a stock market frenzy, only for it to crash spectacularly in 1929. While that’s a broad stroke, the principle echoes today—failing to monitor credit use can lead to personal economic downturns, much like those historical overextensions. In different cultures, say in Japan, where frugality is a virtue, people often keep utilization ratios under 20% as a norm, contrasting with the more laissez-faire approach in the West.

This historical lens reveals a truth: credit usage ratio management isn’t new; it’s evolved from barter systems to digital apps. For instance, the Great Recession highlighted how high utilization rates correlated with widespread defaults, underscoring why debt management strategies are timeless. If I were chatting with a skeptical reader over coffee, I’d say, «Look, you might think it’s all about the big purchases, but it’s the daily drip that floods the basement.» That cultural nod to American idioms like «drip by drip» emphasizes how small oversights accumulate. By examining these parallels, we see that maintaining a low ratio—ideally below 30%—isn’t just advice; it’s a proven safeguard against the kind of financial instability that history warns us about.

The Overlooked Danger and How to Tackle It

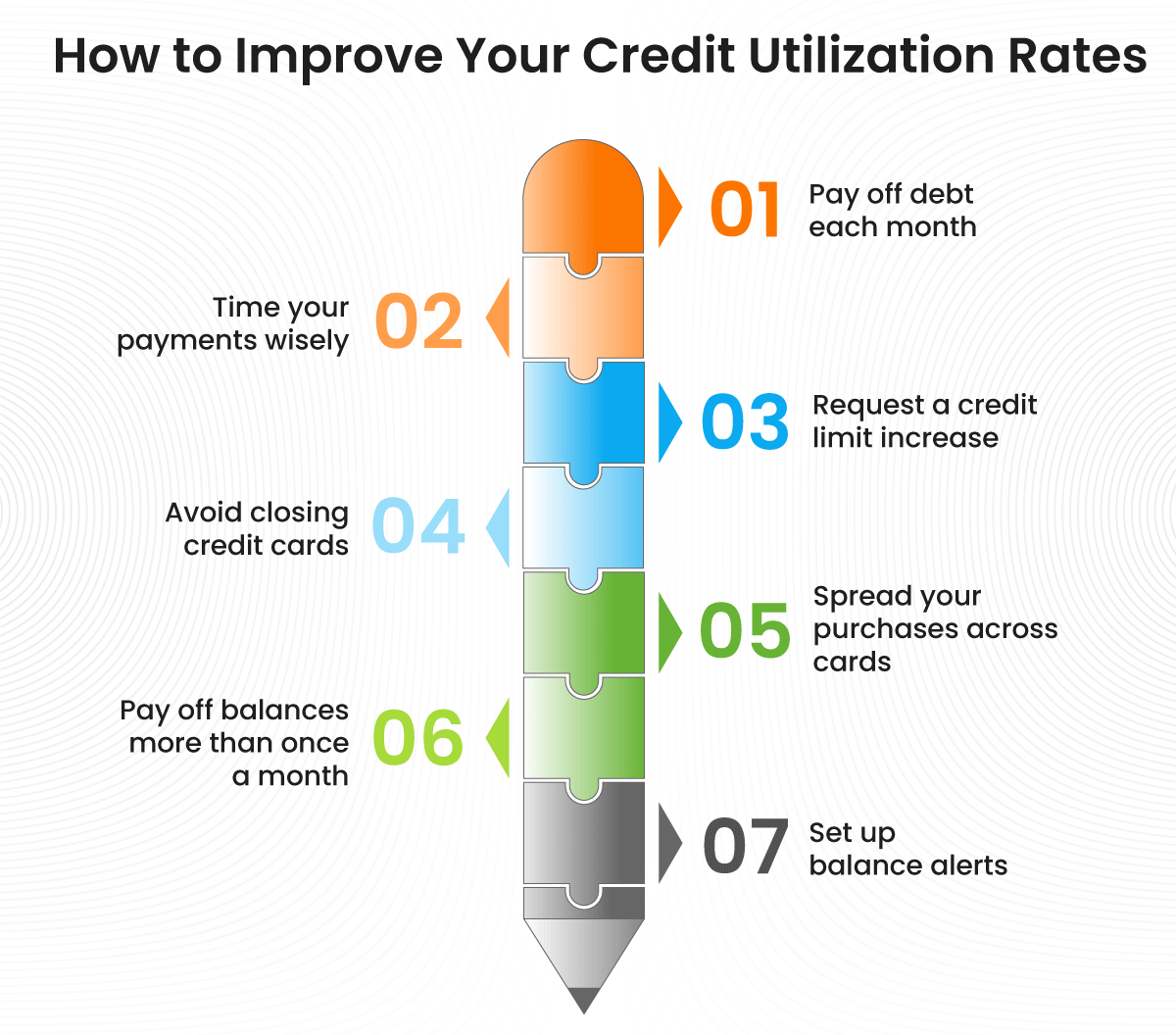

Ironically, in our tech-savvy era, many folks still treat monitoring credit utilization ratios like that dusty gym membership—paid for but ignored. Here’s the inconvenient truth: letting your ratio creep up can inflate your perceived risk, leading to higher interest rates or even denied credit. But hey, it’s not all doom; with a few straightforward steps, you can flip the script. Start by pulling your credit report from bureaus like Experian—it’s free annually and gives a clear snapshot.

To make this actionable, let’s break it down without overcomplicating. First, calculate your current ratio: divide your total credit balances by your limits. If it’s over 50%, that’s a red flag—time to pay down debt. Second, set up alerts through apps like Credit Karma; they notify you of changes, helping you stay proactive. And third, spread out your spending across cards to keep individual ratios low. Think of it as playing a long game, like the meticulous planning in «The Wolf of Wall Street,» minus the excess—strategic, not reckless. By addressing this head-on, you’re not just fixing a problem; you’re building resilience, especially in a country where financial health often means weathering unexpected storms.

A Quick Comparison of Tools

| Tool | Pros | Cons |

|---|---|---|

| Credit Karma | Free, real-time updates, user-friendly | Limited advanced features |

| Experian App | Detailed reports, identity theft protection | May require subscription for full access |

While this might seem straightforward, the payoff is huge—improved scores and lower costs over time.

Wrapping It Up with a Fresh Angle

In the end, what seems like a minor detail in your financial story is actually the plot twist that could lead to a happier ending. Monitoring credit utilization ratios isn’t about perfection; it’s about control in an unpredictable world. So, take this to heart: start by checking your ratio right now and aim to keep it under 30% for the next month. Y justo ahí, when you see your score climb… What overlooked financial habit will you tackle next to secure your future? Leave a comment below and let’s discuss—your insights could help someone else avoid the pitfalls.