Life throws curveballs. That’s the blunt truth many overlook in the hustle of daily finances. Did you know that over 30% of Americans carry insurance policies that haven’t been updated in more than five years? It’s a startling statistic, revealing how complacency can erode your financial safety net. In this article, we’ll dive into why reviewing your insurance policies isn’t just a chore—it’s a smart move that could save you thousands, prevent unexpected gaps in coverage, and give you that hard-earned peace of mind. Stick around, and I’ll share why, from my own experiences in the finance world, this simple habit is non-negotiable.

My Wake-Up Call: A Personal Tale of Financial Oversight

Picture this: I was knee-deep in a career as a financial advisor, thinking I had it all figured out. Then, out of nowhere, a family health scare hit us like a ton of bricks. Y justo ahí fue cuando… I realized my home insurance hadn’t been touched in years. What started as a routine check turned into a scramble when I discovered that rising property values had left me underinsured. It’s a story I’ve seen play out too often with clients—skipping that annual review because life gets busy, only to face the consequences later.

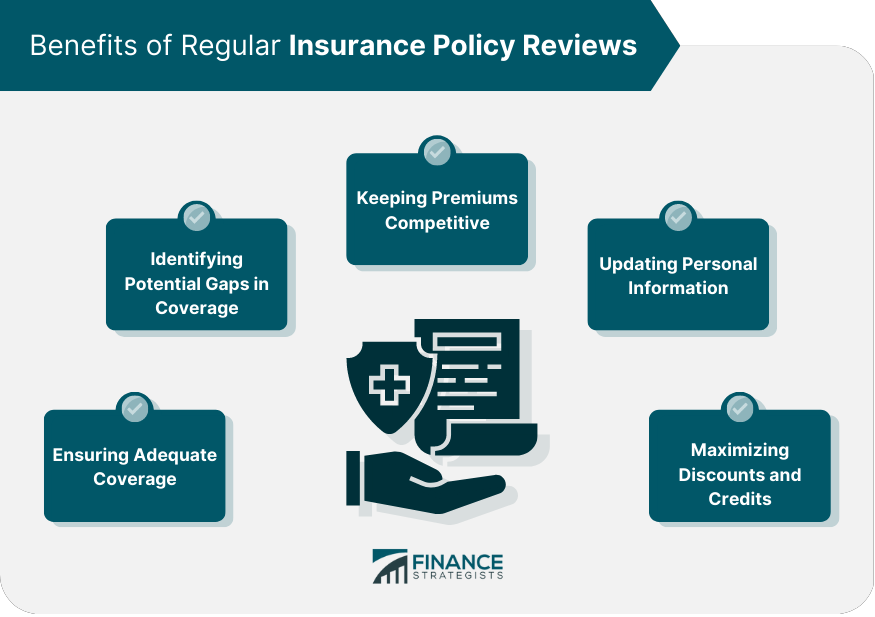

In my opinion, ignoring policy reviews is like driving with worn-out brakes; you might get by, but one bump and you’re in trouble. Think about it: life events like marriage, buying a house, or even inflation can shift your needs dramatically. Reviewing your insurance policies annually ensures you’re not overpaying for unnecessary coverage or, worse, leaving yourself exposed. This isn’t just advice; it’s a lesson from the trenches of real finance work, where I’ve helped folks uncover savings by tweaking deductibles or adding riders for emerging risks.

To make this relatable, let’s compare it to an unexpected metaphor: your insurance is like that old pair of shoes in your closet. They fit fine at first, but over time, they wear thin and don’t protect your feet anymore. In the U.S., with its ever-changing regulations and economic shifts, policies can become outdated faster than you think. And here’s a localism for you—it’s like trying to «make ends meet» in a city like New York, where costs skyrocket, but your policy stays the same.

From Great Depressions to Modern Markets: A Historical Lens on Insurance Evolution

Ever wonder how insurance has morphed over time? Back in the 1930s, during the Great Depression, people scrambled for basic coverage as banks failed and jobs vanished. Fast-forward to today, and we’re dealing with cyber threats and climate change impacts that our grandparents never imagined. This historical comparison highlights why staying on top of your insurance policies is crucial—it’s not static; it’s as dynamic as the economy itself.

Take, for instance, how auto insurance adapted from covering horse-drawn carriages to electric vehicles. If you don’t review, you might miss out on discounts for eco-friendly cars or fail to account for new liabilities like autonomous driving tech. In finance circles, this evolution underscores a hard truth: what worked yesterday might bankrupt you tomorrow. I’ve sat across from clients who, influenced by cultural norms of frugality—like the British «make do and mend» mindset—held onto policies out of habit, only to find they were paying for outdated protections.

Now, to add depth, let’s propose a mini experiment for you, the reader. Grab your latest policy statement and jot down three key changes in your life since you last reviewed it. Has your income grown, or have you moved to a higher-risk area? This isn’t just busywork; it’s a practical step to align your coverage with reality, much like how investors rebalance portfolios during market swings.

The Overlooked Risks in Your Policy—and Straightforward Fixes

Here’s the irony: many folks treat insurance like that dusty file in the attic, out of sight and out of mind, until a claim forces their hand. But lurking in those fine prints are pitfalls like inadequate inflation adjustments or exclusions for modern perils, such as data breaches. In a serious tone, let me tell you, this complacency can cost you big—think delayed claims or denied coverage when you need it most.

To tackle this, start by examining common issues. For example, if your life insurance hasn’t kept pace with your family’s needs, you could be leaving loved ones shortchanged. A simple solution? Schedule a policy audit with your insurer, focusing on long-tail keywords like ‘assessing insurance coverage gaps’. I’ve guided clients through this, using tools like online calculators to compare current versus needed coverage, and it’s transformative.

For clarity, here’s a straightforward table to weigh your options:

| Aspect | Current Policy Drawbacks | After Review Benefits |

|---|---|---|

| Cost | Overpayment for unused features | Potential savings of 10-20% annually |

| Coverage | Gaps from life changes | Customized protection, e.g., adding cyber insurance |

| Peace of Mind | Constant worry about adequacy | Assurance that you’re «covered come what may» |

This comparison, drawn from real finance practices, shows why proactive reviews aren’t optional. And if I can sneak in a pop culture nod, it’s like Tony Stark in the Iron Man films—always upgrading his suit to face new threats. Without it, you’re vulnerable.

Wrapping It Up: A Fresh Perspective on Financial Security

In the end, reviewing your insurance policies isn’t about fear-mongering; it’s about empowerment. Twist this around: what if that annual check-up actually frees up cash for your dreams, rather than draining it? So, take action now—call your insurance agent today and request a comprehensive review. And here’s a reflective question to ponder: How might your financial future change if you treated insurance as a living document, not a set-it-and-forget-it deal? Share your thoughts in the comments; let’s keep the conversation going.