Money whispers secrets. In a world obsessed with daily expenses and fleeting trends, ignoring your net worth is like ignoring a slow leak in your financial boat—it might not sink you overnight, but tracking net worth over time could be the life raft you never knew you needed. Here’s a truth that stings: studies show that only about 40% of Americans regularly monitor their net worth, yet those who do often build wealth 20% faster. The problem? Life’s chaos distracts us from the big picture, leaving us vulnerable to missed opportunities and financial surprises. But the benefit is clear: by keeping tabs on your assets minus liabilities, you gain clarity, spot trends early, and steer towards long-term financial stability. Let’s dive in and see why this habit isn’t just smart—it’s essential.

My Unexpected Financial Awakening

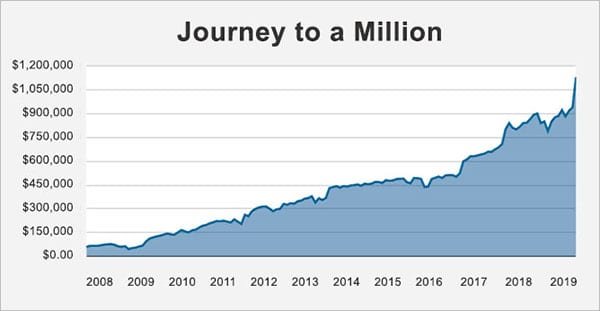

Back in 2012, I was knee-deep in a career that paid the bills but left me feeling adrift. Picture this: I had a decent job in New York, a small apartment, and what I thought was a solid savings account. But when my car broke down and I had to dip into emergency funds, I realized I had no clue about my actual net worth. It was messy—I’d bought stocks on a whim, forgotten about an old IRA, and my debts were scattered like forgotten receipts. That moment, tracking net worth over time became my mantra. My opinion? It’s not about being obsessive; it’s about empowerment. Drawing from my experience, I learned that without regular check-ins, you’re flying blind in the finance world. And just like that rainy day taught me, a simple net worth calculation can reveal hidden strengths, like how my investments had quietly grown despite the market dips. It’s a personal anecdote that underscores a broader truth: in the U.S., where economic mobility is a cultural cornerstone, ignoring this can mean missing out on that classic «American Dream» narrative.

Historical Echoes: How Wealth Builders of Yore Stayed Ahead

Fast-forward from my story to the annals of history, and you’ll find that figures like John D. Rockefeller didn’t just amass fortunes—they meticulously tracked every penny. In the Gilded Age, Rockefeller’s ledgers weren’t just books; they were blueprints for empire-building, showing how net worth tracking helped him navigate oil booms and busts. Compare that to modern-day entrepreneurs: while Rockefeller used pen and paper, today’s apps like Mint or Personal Capital offer real-time insights, but the principle remains. Here’s an unexpected analogy—think of it like a family recipe passed down, evolving from grandma’s handwritten notes to a digital cookbook, yet still preserving the essence of financial health. In British terms, it’s a bit like keeping a «proper ledger,» emphasizing the cultural value of prudence. This historical lens exposes a myth: that tracking is only for the ultra-rich. The uncomfortable truth? Even middle-class families in the 19th century used simple balances to weather recessions, proving that monitoring personal finances over time is a timeless strategy for anyone aiming to outpace inflation and build generational wealth.

A Closer Look at the Rockefeller Method

Rockefeller’s approach involved quarterly reviews, much like today’s recommended annual net worth assessments, blending discipline with adaptability.

The Stealthy Pitfalls and How to Outsmart Them

Ever feel like your finances are a house of cards? Irony hits hard when you realize that not tracking net worth over time can turn small oversights into towering problems—like ignoring a credit card bill until it’s «in the red,» as we say stateside. The issue? Life events, from job losses to market crashes, can erode your net worth without you noticing, leaving you reactive instead of proactive. But here’s the solution, wrapped in a serious nudge: start with a basic formula—assets (cash, investments, property) minus liabilities (debts, loans). Number it out: 1. Gather your statements; 2. Calculate totals; 3. Review quarterly. This isn’t just advice; it’s a safeguard, especially in a culture where, as in pop culture hits like «The Big Short,» ignoring the numbers led to downfall. And that’s when it hits—long-term wealth building isn’t about luck; it’s about consistent monitoring to adjust sails before the storm. By adopting this, you’re not just avoiding pitfalls; you’re crafting a narrative of control, much like a steady captain in turbulent seas.

Wrapping It Up: The Power Shift in Your Pocket

In a twist, tracking net worth over time isn’t just about numbers—it’s about reclaiming your story in a world that often feels out of control. Think of it as flipping the script: what if that routine check revealed you’re wealthier than you thought, spurring bolder moves? My call to action: grab a notebook or app right now and jot down your current assets and liabilities—it’s that straightforward. And here’s a reflective question to ponder: if your net worth told your life’s financial tale, what chapter would you want to rewrite? Share your thoughts in the comments; let’s keep the conversation going on building a secure future.