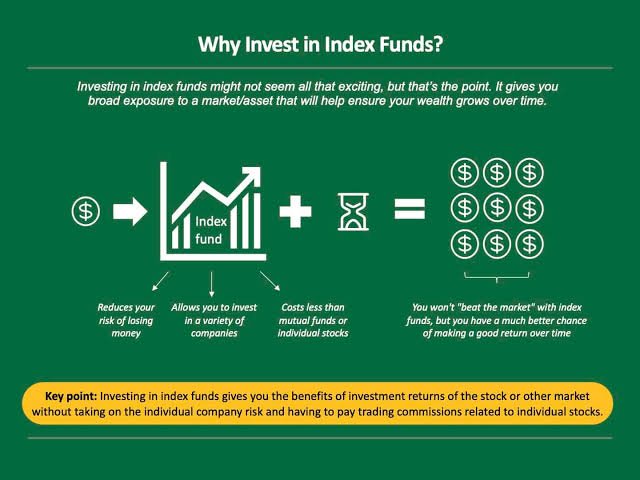

Silent wealth accumulators. Yes, that’s what index funds are—often overlooked in the frenzy of day trading and stock picking, yet they’ve quietly built fortunes for everyday investors. Here’s a shocker: while Wall Street hotshots chase the next big win, data from Vanguard shows that over the past 15 years, the average index fund has beaten 80% of actively managed funds. The problem? Many folks think investing means constant monitoring and risk-taking, leading to stress and subpar returns. But the real benefit for you is straightforward: index funds offer a passive, diversified path to growth that minimizes fees and maximizes long-term gains. Let’s dive into why swapping complexity for simplicity could be your smartest financial move.

My Unexpected Journey into Passive Investing

Picture this: back in 2010, I was glued to my computer screen, obsessively tracking tech stocks like a kid with a new video game. I’d heard about index funds from a friend who swore by them, but I thought, «Nah, that’s too boring—who wants to mimic the market when you can pick winners?» Then came the reality check. During the 2011 market dip, my portfolio tanked because I’d bet big on a few volatile stocks. Losses piled up, and I remember thinking, «This is madness.» That’s when I stumbled upon Warren Buffett’s famous bet—proving that a simple S&P 500 index fund outperformed hedge funds over a decade.

My turning point? I diversified into an index fund tracking the total stock market. No more sleepless nights; it was like switching from a rollercoaster to a steady train ride. **Diversification** became my mantra, spreading risk across hundreds of stocks instantly. This personal anecdote isn’t just about me—it’s a lesson for you. In a world obsessed with get-rich-quick schemes, index funds remind us that steady, broad exposure often wins. And just like Buffett’s wisdom, it’s a no-brainer for building wealth without the drama.

Wall Street’s Historical Echoes and Modern Lessons

Ever wonder how the Roaring Twenties led to the Great Crash of 1929? It’s a stark reminder that active trading, fueled by speculation, can unravel economies. Fast-forward to today, and index funds represent a cultural shift—from the individualistic heroics of stock pickers to the collective wisdom of the market. Think of it like democracy in action: instead of one loud voice, you get the aggregate of thousands, which, historically, has proven more stable.

Compare that to the dot-com bubble, where chasing individual tech darlings like Pets.com ended in disaster for many. Index funds, on the other hand, would have kept you grounded by mirroring the broader market’s recovery. Here’s a simple table to illustrate the advantages:

| Aspect | Active Funds | Index Funds |

|---|---|---|

| Fees | High (1-2% annually) | Low (0.05-0.2% annually) |

| Risk Level | High due to stock selection | Lower through **diversification** |

| Long-Term Returns | Often underperform benchmarks | Match or exceed market averages |

This comparison isn’t just numbers; it’s about learning from history’s mistakes. As an investor, you’re not fighting the market—you’re partnering with it, much like how global indices reflect economic realities rather than fleeting trends.

The Illusion of Control: Why Active Trading Falls Short

What if I told you that trying to outsmart the market is like betting against the house in Vegas? Sure, you might win big occasionally, but the odds are stacked. A common myth is that **active investing** guarantees superior returns through expert picks, but studies from Morningstar reveal that only about 12% of active funds beat their benchmarks over 10 years. And that’s when I realized… the costs add up, from transaction fees to taxes, eroding those supposed gains.

Let’s flip this on its head with a quick thought experiment: imagine you’re at a party, and everyone’s shouting about their latest stock tip. Instead of joining in, step back and ask yourself, «Do I really need to pick every song, or can I just enjoy the playlist?» Index funds solve this by offering a pre-set, low-effort solution—automatic diversification across sectors and countries. It’s not about being lazy; it’s smart strategy. For instance, an S&P 500 index fund gives you exposure to giants like Apple and Amazon without the guesswork, proving that sometimes, less really is more in finance.

In wrapping this up, here’s a twist: what if the key to financial freedom isn’t in beating the market, but in not losing to it? Index funds aren’t just tools; they’re your ticket to a worry-free portfolio. So, take action now—research a reputable index fund like the Vanguard Total Stock Market ETF and add it to your investments today. And one more thing: what’s stopping you from embracing this simple approach? Is it fear of the unknown, or just the thrill of the chase? Share your thoughts in the comments; I’d love to hear how you’re navigating the investment world.